TUAC NEWS

Unemployment to rise until 2011, according to OECD forecasts

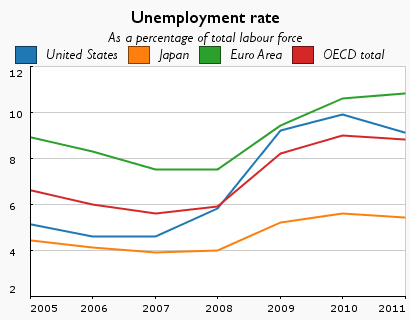

Unemployment across the OECD is predicted to continue to rise well into 2010 and to fall only modestly in 2011 from its peak of over 9% of the labour force. GDP growth for the OECD zone is projected to be -3.5% in 2009 and +1.9% in 2010. The OECD instructs governments to undertake tough fiscal consolidation measures before 2011, including cuts in public services, “long overdue” reforms of healthcare and pensions and regressive tax reforms.

19/11/2009

The key message of the OECD Economic Outlook No. 86 released today is that the economic recovery now spreading across the OECD “is still too timid to halt the continuing rise in unemployment”. OECD-wide unemployment is predicted to continue to rise well into 2010 and to fall only modestly in 2011 from its peak of over 9% of the labour force. The jobless rate is expected to peak in the first half of 2010 in the US, but for the Euro zone only in 2011 will unemployment finally start to fall.

Source: https://community.oecd.org/community/factblog

The downside and upside risks are significant. Among the downside risks, the report notes that the pace at which households will continue to de-leverage from past excessive debt levels could result in lower than expected consumption. Similarly it considers that international imbalances of current accounts, which have in fact narrowed during the crisis, could well start to increase again with the risk of “disorderly exchange rate adjustment”, contrary to forecasts that these will stabilise.

Among the upside risks, the OECD notes the possibility of a stronger than expected rebound in international trade and in business investments. Yet, overall it considers that the fall-out from the downside risks “could be much worse” in the context of low inflation, which is set to fall further in most countries, citing Japan’s experience of the 1990s.

In its report, the OECD acknowledges that fiscal stimulus packages “appear to have succeeded in limiting the severity of the downturn and contributing to the recovery”. Yet, it recommends that governments start communicating on their exit strategies.

For the majority of OECD countries, monetary policy should “move slowly”: raising interest rates back to “neutrality” should take place only “by the time inflationary pressures begin to be felt”. Yet, current differences in interest rates across countries could result in “capital movements and pressure on asset prices” that once combined with easy monetary conditions could “risk spilling over into unjustified asset price increases”. Unconventional monetary policies that were put in place to bail out the banks and revive the credit market – such as funding guarantees and extensions of deposit guarantees – should be phased out gradually.

It is, however, on fiscal consolidation that the OECD recommendations are most aggressive. In the context of today’s enormous budget deficits and rising government debt, the OECD calls for “substantial” if not “drastic” fiscal consolidation measures to be undertaken, by 2011 at the latest.

Recommended measures include spending cuts in healthcare, primary and secondary education that boost public sector efficiency “by maintaining outputs and cutting inputs” and reducing expenditure “on other core public services”. The OECD considers that early implementation of “long overdue reforms” to pension schemes “could help signal” government commitment to fiscal consolidation.

On the revenue side, it recommends the implementation of regressive tax reforms that “contribute to growth”, including lowering direct taxation (cuts in corporate income tax and in personal income tax) while increasing indirect taxation, such as VAT and property taxes.

On a more positive note, the section on medium-term financial regulation signals a toughening of the OECD position on large banks and other complex financial groups that represent “potential risks for financial stability and for the taxpayer”. The OECD argues that the past failure to take action to break up banks that are “too big or too interconnected to fail” requires governments to put in place tough regulation that reduces “incentives for banks to reach systemic size”.

Web links:

- Main page of the OECD Economic Outlook n°86 www.oecd.org/oecdEconomicOutlook

- OECD handout for journalists

- CHAPTER 1 on the General Assessment of the Macroeconomic Situation

- CHAPTER 2 on the car industry

- Country summaries for all member countries as well as for the accession and enhanced engagement