TUAC NEWS

Davos 2009: Dramatic Turn in Growth and Employment Forecasts Requires Immediate Government Action for Employment and Re-regulation of Finance

29/01/2009

- 0901t_gf_davospdf

As the political and financial elites meet in Davos for the World Economic Forum Annual Meeting, new forecasts published by the ILO and the IMF show a dramatic turn in the global economic crisis which could become the worst ever in 60 years. For unions leaders present in Davos, the global financial crisis now threatens to become a social timebomb if the world’s governments don’t act together to save and create jobs. “Governments must put working families first in the management of this crisis, and this means two things: engage bold stimulus and social safety packages to save employment and the real economy, and agree on a reform roadmap to re-regulate global financial markets”, says TUAC General Secretary John Evans.

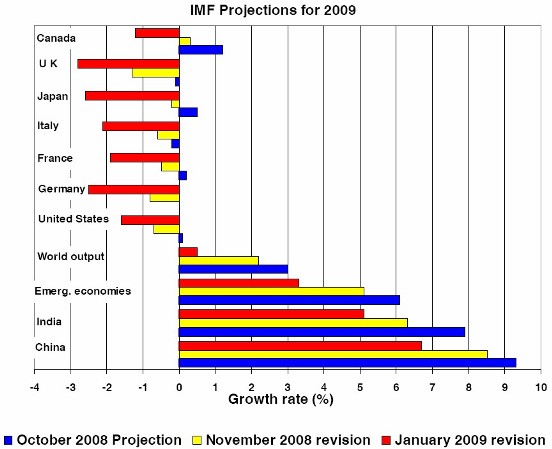

In its annual 2009 Global Employment Trends report, the ILO predicts up to 50 million jobs to go and 200 million more into absolute poverty. The IMF meanwhile has published revised growth figures for 2009, showing a radical revision of its previous forecast. The news only add to the sense of urgency of the Global Unions Statement to Davos, which among others calls for coordinated fiscal stimulus to maintain and create jobs, for investment in infrastructure, education and health, for a “Green New Deal”, actions to keep existing employment and strengthen unemployment and social security schemes, boosting development aid and emergency lending to developing countries, and action on the global food crisis.

TUAC and Global Union partner organisations have warned governments against the unsustainable model of growth that has prevailed across the world economy in the past decade. “The benefits of globalisation in the industrialised countries have accrued disproportionately to the wealthiest families, while the majority of working families are excluded from sharing in increasing productivity and economic growth”, said TUAC and Global Unions to the G8 already in 2007, citing evidence of falling share of wages as a proportion of national income and rising inequality throughout the OECD and across developing countries.

The deepening of the financial crisis has exposed the major flaws in the economic and financial framework that has governed OECD economies, notably:

- Persistent structural imbalances within OECD regions and with key emerging economies;

- A model of growth based on insolvent demand, debt-financed household consumption, wage compression, and the transfer of market risks on to workers (pensions, housing);

- An un-controlled and conflicted ‘structured finance’ industry in which credit risks were not spread but hidden;

- More broadly, the creation of a shadow banking sector riddled with regulatory and tax arbitrage behaviours, encouraging irresponsible risk-taking and leverage investment strategies;

- Widespread corporate short-termism and “shareholder value” governance undermining market integrity and stakeholders’ long term interests.

Beyond immediate actions to save employment and the real economy, governments must agree on an ambitious roadmap for re-regulation of finance. For OECD general Secretary Angel Gurria “To restore the trust that is fundamental to functioning markets, we need better regulation, better supervision, better corporate governance and better coordination”. For TUAC, re-regulating financial markets in the aftermath of the crisis would mean:

- Strengthening international financial safeguards and cooperation, including fair risk-sharing and prudential rules for banks, public accountability of central bankers and other financial supervisors, offshore financial centres and tax heavens;

- Diversifying finance and protecting working families social rights, including strengthening household consumer protection, developing community-based financial services and pension regulation;

- Spreading responsibility throughout the investment chain, including re-regulation of credit risk transfers, of private investment funds and conglomerates, and reigning in executive compensation and corporate short-termism.

links: