OECD rings alarm bell on oligopolistic structures created by "too-big-to-fail" global financial conglomerates

Concentration in the banking sector increased post-crisis, particularly in the derivatives markets. "The oligopolistic structure of banking likely contributed to the financial crisis", says OECD. Credit rating agencies fuelled "ratings inflation" pre-crisis.

24/08/2011

Bank competition and financial stability - Download the E-book (PDF, 9.8Kb)

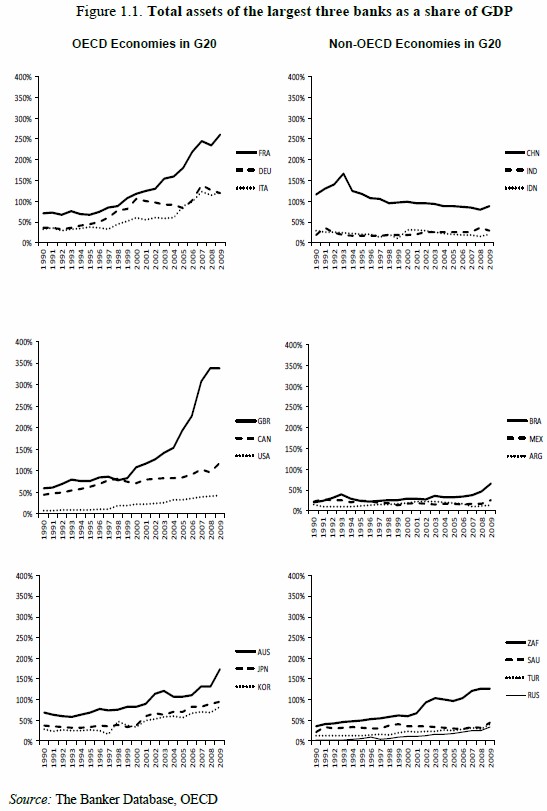

In this publication OECD experts raise deep concerns about the excessive concentration that has taken place in the banking sectors across OECD economies, pre-crisis AND post-crisis:

- “It can be argued on competition grounds that the oligopolistic structure of banking likely contributed to the financial crisis”.

- Global financial conglomerates that ahve become too-big-to-fail (TBTF) have increased their market shares in key derivative markets. While 30 banks dominated the foreign exchange forward rate market and 14 the options market in 1998, in 2001 these markets were dominated by 14 and 10 firms respectively. In the fast growing market for ETF, early movers are now being overshadowed by the larger G-SIFIs.

- “While the failures of the market for credit rating agencies were not the actual cause of the financial crisis, they do indicate the need for fundamental reform in the market and of the business models used.”

Several factors are at play in the continuation of the concentration process post-crisis:

- The collapse of some major players (Merrill Lynch, Lehman Brothers, Bear Stearns) and the wave of mergers & acquisitions that followed.

- Subsidized by taxpayers by their TBTF status (see sections following), G-SIFIS have access to resources more cheaply. Market assumptions are that they benefit from implicit backing of the governments hosting their headquarters;

- Technical barriers remain – derivatives trading is highly consuming in technological infrastructure.

Links:

- 12/08/2011 : Bank competition and financial stability, OECD report

- Main webpage of the OECD Financial Market Trends - Journal

Extract