TUAC NEWS

OECD INSISTS ON FISCAL EXPANSION “TO ESCAPE THE LOW-GROWTH TRAP”

24/11/2016

The upcoming Economic Outlook (to be released on the 28th of November) is calling for a rethinking of the current fiscal policy stance. Chapter 2 (“Using the Fiscal Levers to Escape the Low Growth Trap”) was released on the 24th of November ahead of the Outlook ( http://www.oecd.org/eco/using-fiscal-levers-to-escape-the-low-growth-trap.htm ).

As point of departure, it recognises that the ‘global economy remains in a low growth trap’ and that ‘monetary policy is overburdened’. Hence, a stronger fiscal policy response is needed. With record low sovereign interest rates, the fiscal space to robustly accelerate growth exists.

The OECD estimates that if governments were to undertake a ‘productivity enhancing’ fiscal expansion of 0.5% of GDP, the output gain in the first year would be 0.4-0.7% with business investment lifted by a median of 0.7% in most advanced economies.

If such expansionary fiscal policy is conducted jointly among the large advanced economies, the additional output gain after one year would be 0.2%.

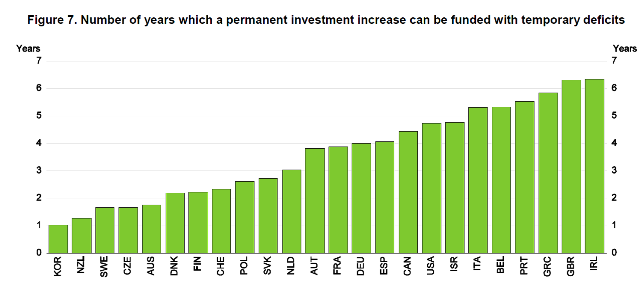

The OECD also estimates that a fiscal expansion of 0.5% of GDP can be maintained on average for three to four years without raising the debt-to-GDP ratio in the medium term. In the case of the UK and Ireland, this fiscal expansion could be run over a period of up to 7 years (see figure below). Public investment projects need to be sound and should target green infrastructure and spending on quality education and health provision, and research and development.

In the long run, a gain of 2% in output can be achieved with a permanent increase in public investment, the financing of which would be shifting after three to four years from deficits to non distortionary taxes and/or cuts in other spending.

What the OECD is recommending

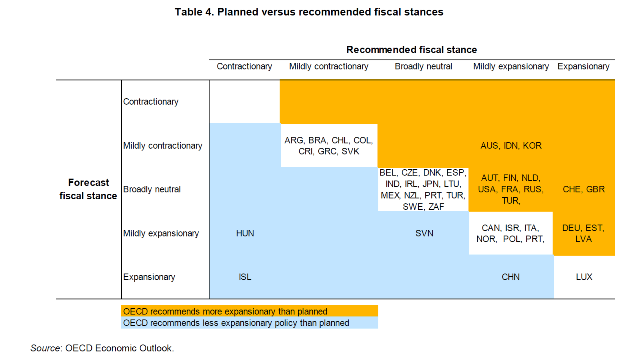

Under current fiscal plans, the fiscal stance in advanced economies is expected to be broadly neutral in 2017. The OECD therefore recommends that a number of large economies including Germany, the US and the UK borrow more to raise public investment. The table below provides an overview of the planned fiscal stance versus the one the OECD is recommending, both for advanced as well as emerging economies.

Other economies are being advised to launch public investment by using tax and spending levers, in other words by lowering non-productive spending and/or by raising non-distortionary taxes. However, references are also made to cutting public subsidies, raising the retirement age and, property or consumption taxes.

Existing fiscal rules could limit the recourse to fiscal expansion in about half of the countries considered. The OECD is therefore openly calling for a modification of the application of the EU Stability and Growth Pact by excluding net public investment from fiscal rules.

General assessment

- With growth being ‘too low for too long’ and with monetary policy “pushing on a string” (cfr the zero nominal interest rate bound), a public investment stimulus is necessary and indispensable to break the deadlock and get the economy out of the ‘low growth trap’.

- The recommendation to change the modus operandi of the Stability Pact and to adopt a ‘golden rule’ on public investment is particularly welcome. Here, it is useful to recall that the origins of the 3% deficit criterion go back to such a ‘golden rule’ as public investment at the time of the signing of the Maastricht Treaty indeed reached 3% of GDP in Europe.

- At the same time, the consistency of the OECD analysis can be improved where structural reforms are concerned. If monetary policy is now overburdened, the reason is that, alongside austerity, labour market reforms had a disinflationary impact. Policy makers should therefore be wary of a policy mix where the fiscal stimulus that is provided to assist monetary policy is again offset by reforms pushing demand and activity back down. Previous OECD work (Going for Growth 2016, chapter on Reforms in a difficult macro context http://www.keepeek.com/Digital-Asset-Management/oecd/economics/economic-policy-reforms-2016_growth-2016-en#page65 ) pointed out that some labour market reforms have significant negative economic effects in times of crisis. Taking the ‘low growth trap’ seriously and indeed moving away from a situation where inflation is too low, calls for a smarter structural reform agenda that invests in labour markets and quality jobs instead of pushing for more flexibility.